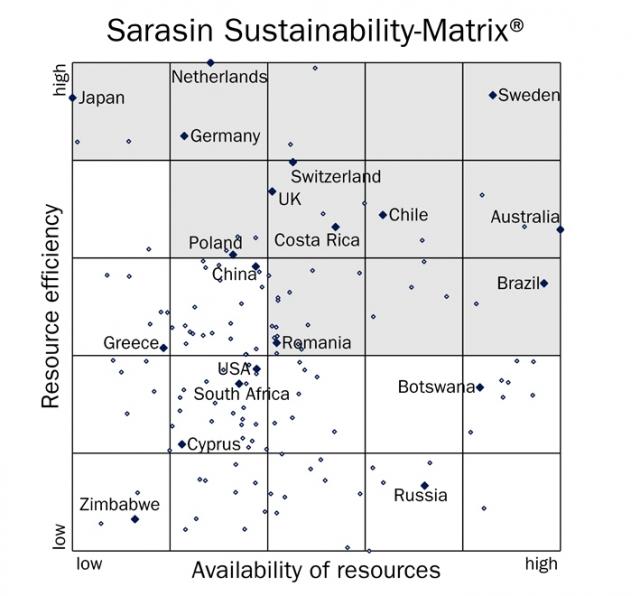

If you open up the papers lately, you’ll find the discussion of the sovereign debt crisis tends to focus narrowly on offending nations’ profligate spending and borrowing habits. While these behaviors have no doubt contributed to fiscal deficits, what is often overlooked is that addressing another kind of deficit–an ecological one–is of equal importance if nations are to sustain healthy and resilient economies. One bank is working to advance this notion by incorporating into its sustainability rating of sovereign debt a country’s resource efficiency. Bank Sarasin, a Swiss private bank founded in 1841, launched the first investment fund based on the concept of eco-efficiency in 1994 and has been including social factors in its sustainability ratings since 1997. Sarasin’s sustainability rating of sovereign debt assesses a country’s creditworthiness based not only on resource availability but also on resource efficiency. Viewing a country’s ability to repay its debt over the long-term through this holistic prism yields some noteworthy results: resource-rich but inefficient economies such as the United States and Russia appear particularly vulnerable to future rating downgrades while resource-scarce but efficient countries like Japan, the Netherlands, and Germany appear much less at risk.

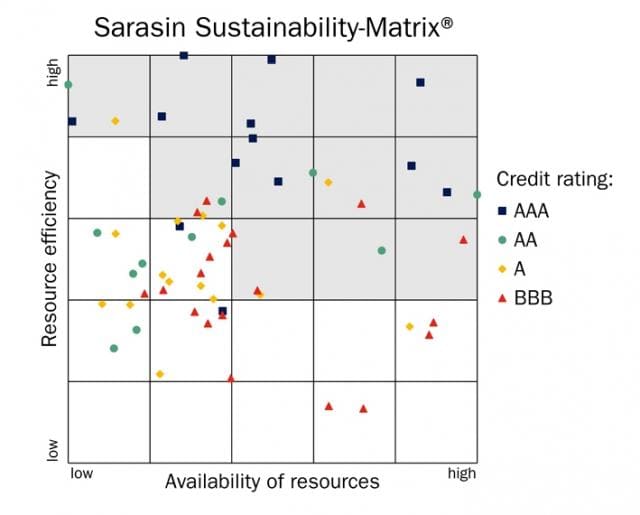

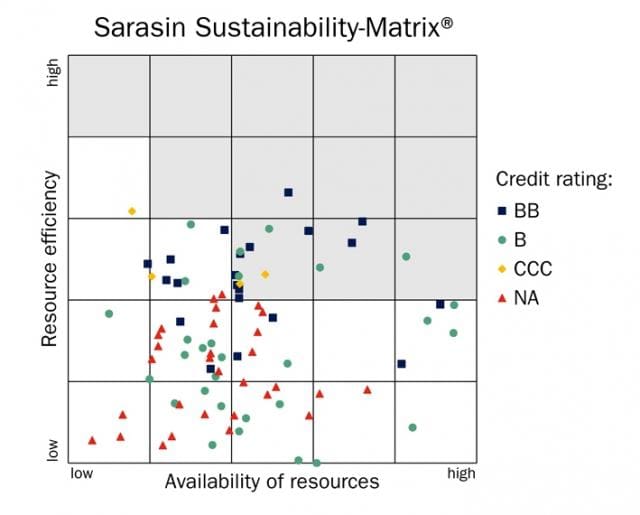

The Sarasin sustainability rating is formulated by plotting a matrix with “availability of resources” on the x-axis and “resource efficiency” on the y-axis. Those countries scoring highest in the resulting scatter diagram are located in the upper right quadrant and those scoring lowest in the lower left. Bank Sarasin uses this methodology to determine whether a country is a candidate for inclusion in its sustainability funds. Sarasin considers a variety of factors in its analysis, including a country’s biocapacity, its Ecological Footprint, “ecological deficit or surplus,” nuclear energy generation, water footprint, human capital and financial capital. The inputs also include dimensions of climate change, such as changes in agricultural productivity, population and land area in low-elevation coastal zones, and animal species diversity. To determine the efficiency of resource-use, Sarasin assesses quality of life indicators, including health, education and material wealth and introduces two novel metrics: “transformation efficiency” — a measure of quality of life achieved against the rate of resource consumption required to achieve it — and “process efficiency,” which measures the “efficiency” of societal, political, and economic processes.

Conclusion

Viewing investments in sovereign bonds from a sustainability perspective, Sarasin’s methodology obviously tends to rate the debt of countries with ample resources and high resource efficiency higher than those with low resource availability and low efficiency. That said, as noted above, countries that make efficient use of scarce resources may in the long-run achieve a higher rating in the Sarasin Sustainability Matrix than those that squander their ample resources.