Jobs. Depending on how you count, the challenge is 7 to 10 million net new jobs in the United States over the next 5 years or so from a current base of about 130 million. A five to seven percent increase, the sooner the better. Here’s how.

First, we need to break the challenge down into two pieces: emergency triage, and long-term

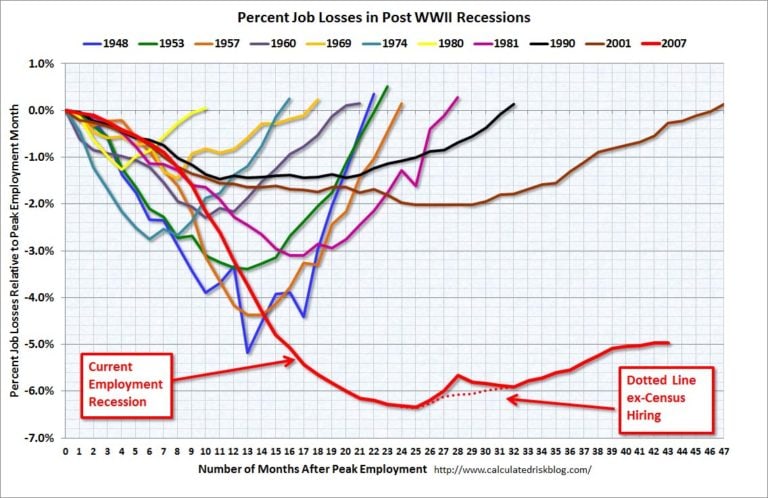

structural reform. The case for emergency triage is clear; this recession is different, for the reasons we are all familiar with [1].Even if there were the political will and leadership in government for a second larger stimulus, which there’s not, the government’s ability to do what it takes has been compromised by the Wall Street induced financial crisis.

We need a hero. We need leadership from the only sector that has both the ability and the means to make a difference. Big business. To suggest I’m naïve about this proposal is to be naïve about the predicament we are in, prospects of a double-dip recession being merely the near-term cyclical threat. This idea crystalized for me upon reading about AT&T’s pledge to repatriate 5000 call center jobs (about 2% of its workforce) as part of its opening bid in negotiating with the Justice Department over its proposed T-Mobile acquisition.

Instead of whining about confidence and regulatory uncertainty, big business, which is living in the relative luxury of record profitability on the back of decades of labor productivity gains that are at the root of the problem, simply must lead. Big business depends on recovery in the largest economy in the world. It’s in its self-interest to be, dare I say, patriotic. Bill O’Reilly can get the competitive juices flowing in what he will coin the “Corporate Patriots and Pin Heads” segment of his show.

Generalizations are unfair. But exceptions notwithstanding, big business means mature industries where the game is primarily growth through acquisition and cost rationalization. In addition to many strong attributes, big business is good at exploiting its scale advantage by eliminating jobs or outsourcing them in the name of “productivity improvement.” Time to think outside the box. The last man standing does not mean the last man thrives.

The Fortune 500 employ about 18 million people according to my research. They can if they chose productively increase employment 5% and create low-cost intern programs for unemployed high school and college graduates equivalent to another 5% – 1.8 million jobs and 1.8 million internships within a year, at no harm to profit margins while generating numerous long-term corporate benefits. Here are just a few ideas for how to accomplish this:

- Reverse at least temporarily the growing (and unsustainable) wealth gap to provide funding for the new jobs. Why not a three-year compensation cut of 3% for all employees earning over $250,000, 5% over $500,000, 7% over $1,000,000, 25% over $5,000,000. Offset with some deferred stock since shareholders will be long term winners too. CEO’s should compete to be bolder and show us real leadership. Remember, some of our sons and daughters have given their lives for our country. Talk to their families about sacrifice.

- Job share and shorter work weeks. See Germany for example.

- Solicit ideas from Wall Street’s “creative” wiz kids aimed at job creating without eroding profit margins, giving these talented but maligned professionals a shot at redemption. Start with culture-shifting job creation programs in their own firms.

- Or, tell Wall Street that it’s in their companies’ long-term interest to erode profit margins a bit now to be a “Corporate Patriots” leader. Certainly Apple’s margins can absorb the impact of making something in the US – probably could even charge a premium for an “American Apple.”

Mid-sized businesses can probably achieve collectively the same as the Fortunate 500, but to be conservative let’s assume only half, another 1.8 million jobs and internships.

There’s your “stimulus program” that creates over 5 million jobs within a year. Add some politically feasible stimulus initiatives such as an employment tax credit to grease the wheels and funds to prevent teacher cuts and you have real “animal spirits” catalyzed by the human spirit.

Government policy should concentrate on one task: stimulating the critical long-term structural reform that the new economy will require in order to meet the profound 21st-century challenge of absolute resource limits. For starters:

- Reexamine the principles of our global trade philosophy to reflect the reality of absolute advantage that comes with the free mobility of capital in contrast with theoretical “comparative advantage” that requires assumptions that don’t exist in the real world. What is good for General Electric may not be good for America.

- Develop a strategy to build economic resiliency, which may come at the cost of our obsession with “efficiency.” Systems can be too efficient and collapse (see finance). The decentralization of food and energy production to sustainable systems is job one. Eliminating fossil fuel and agriculture subsidies is the place to start. A big challenge worthy of political capital, vital payoff.

- Focus on stimulating the private sector creation and expansion of small businesses where 65% of the jobs are and over 100% of net new job creation comes from. Eliminate big business corporate welfare. If there’s no screaming and no stock prices of certain companies going down, it’s not working.

- Shift from promoting an “ownership society” aimed solely at housing to an “ownership society” aimed at business enterprise, thereby truly democratizing wealth[2] and creating a nation of business owners. Capital Institute and Jeffrey Hollender, co-founder of Seventh Generation are intrigued with the potential of cooperative models such as the Evergreen Cooperatives experiment in Cleveland under the inspirational leadership of The Democracy Collaborative and the Cleveland Foundation.

- Create the infrastructure bank as contemplated and consider other public-private banking models with shared risk and reward in response to the banking system’s failure to support its vital public purpose. Prioritize low or negative carbon infrastructure such as low-cost financing for energy efficiency investments.

- Phase-out the income tax on incomes below $100,000 and replace it with a carbon tax that escalates predictably over the next 10 years, reaching the equivalent of $12 per gallon of gasoline to cover the estimated indirect costs of oil consumption such as our presence in the Middle East. Add a surcharge for “luxury carbon” usage such as in corporate jets, yachts, and yes, NASCAR racing.

- Tackle the long-term structural deficits following the guidelines of the Simpson Bowels framework as a start, making ample room for significant new investments in education through far more dramatic reductions in our military budget.[3]

America can still lead. American business has a critical leadership role to play, now. Show us what leadership looks like. Character is what we do when no one is watching.

See www.democracycollaborative.org

See “Debt Limit Nonsense” including Bush-appointed Secretary of Defense Gates’ comment that the Navy’s battle fleet “is still larger than the next 13 navies combined—and 11 of those 13 navies are U.S. allies or partners.”