The debt limit negotiations are 99% political and 1% economic, so I have little directly to say about them. But I do have some related thoughts to share as we stumble toward the deadline, with much wasted tax payer money paying for amateur hour in Washington while real challenges are left to smolder and in some cases burn.

I was surprised to learn that Americans for Tax Reform (ATR) has been around since 1985, founded by a 20-something Grover Norquist at the request of Ronald Reagan. I never heard of the guy until the recent debt limit debacle, which seems to have given him a nice platform, most recently with a feature op-ed in the NY Times, “Read my Lips: No New Taxes.”

ATR’s goal is to reduce the size of government as a percentage of GNP — simple, clear. Reasonable people will debate the proper scale and functions of government. If ATR is serious, it should have two priorities in addition to wrestling with our demographics challenged entitlements spending, both missing from what I have seen: the military budget and financial reform. Let me explain.

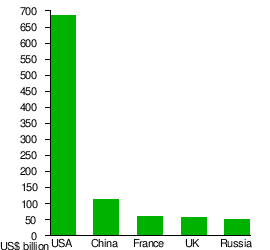

The US is the largest economy in the world. There is no reason why we shouldn’t realize some “economies of scale” with our military might. But for some reason, no one ever suggests that as GNP grows, our military should shrink in comparison. Of course there are many reasons why this does not happen, but the chart below suggests there’s some room for progress. By the way, these numbers do not include the cost of the Iraq War, and our decade-long involvement in Afghanistan, wars that Nobel economist Joseph Stiglitz estimated back in 2008 to have costs in excess of $3 trillion if one includes the life long medical obligations to our service men and women, and the interest cost on the related debt.

Is ATR up to their stated goal? To quote Norquist himself, “There is only one fix for a spending problem, spend less.” The United States’ grotesquely outsized military budget is the natural place for ATR to focus. In discussing the need for a fresh look at US military spending priorities, Bush-appointed Secretary of Defense Gates noted that the Navy’s battle fleet “is still larger than the next 13 navies combined—and 11 of those 13 navies are U.S. allies or partners.” Go at it ATR, and don’t be mislead into comparing spending as a percent of GNP. Look at dollars!

Of course, Norquist is wrong when he says the only way to tackle our spending problem is to cut spending. The second priority if one is serious about restraining the scale of government spending is to aggressively manage the risk of a catastrophic economic collapse of the nature we just experienced as a result of Wall Street’s irresponsible (and worse) behavior.

The recession exploded the budget deficit. That’s why we’re in the bind we’re in. So if ATR’s goal is to reduce government spending as a share of the economy, then we should see them sitting across the table from the banks demanding much more stringent capital requirements, restrictions on liability mismatches, and demanding restructuring of the industry to truly eliminate “too big to fail”… Where are you when we need you Mr. Norquist? The banks are kicking our rear ends, again, setting us up for an even greater collapse when our economy is far less resilient than it once was.

Real tax reform has nothing to do with the absurd Washington manufactured charade around the debt ceiling. It’s embarrassing to watch. Real tax reform must grasp the great transition our economy faces at the beginning of the Anthropocene. ATR would do well to study Herman Daly and many other thoughtful economists’ calls for shifting the tax burden away from income (a good) and onto unsustainable resource depletion (a bad).

An income tax on the wealthiest among us, who no doubt have benefited most from the many great opportunities this great country provides, is the exception to Daly’s proposal to shift the tax burden to resource throughput. Given the well documented evidence that a wide and worsening wealth gap is associated with numerous social costs, and at the extreme leads to political instability, a highly progressive income tax on the top one or two percent of income earners is good for America and just. It is for this reason that I joined the call from Patriotic Millionaires for Fiscal Strength for a tax hike on those fortunate Americans who earn more than $1 million a year.