In today’s world, the prevailing financial ideology wields an overwhelming influence on the course of human lives and the health of our planet, posing a significant threat to the fabric of society and the environment. At the core of this ideology lies a series of unchallenged “absolute truths” that prioritize wealth accumulation, power, and unchecked economic growth, at the expense of communal well-being and ecological sustainability.

Drawing upon an insider’s understanding of the world of high finance from Capital Institute Founder and President John Fullerton, as well as the principles and patterns of sustainability found throughout living systems in the real world, Finance for a Regenerative World provides a frank assessment of our flawed finance ideology, and a bold, principles-based framework for the future of Finance.

These systemic flaws, deeply ingrained in our collective consciousness, fosters a model of finance that is misaligned with the intricate dynamics of life itself. It perpetuates a cycle of exploitation, undermining the vitality of our communities and the natural world.

Determined to confront these deep-rooted flaws, Since its founding in 2010, Capital Institute and its collaborative network have been on a journey in search of a path that leads beyond today’s unsustainable economic system and the finance-dominated ideology that drives it toward an economy that operates in service to human communities without undermining the health of our biosphere and all life that depends on it. Finance for a Regenerative World is more than a mere call for reform; it’s an open invitation to collaboratively envision a financial framework that honors ecological harmony and equitable well-being throughout the world

In taking up this challenge, we seek to explore the answer to a single, vital question:

What would Finance look like if it were to operate genuinely in service of healthy human communities, and without undermining the long-term health of the planet in the process?

In the quest imagine a bold transformation of the global financial system, we turned to the profound wisdom embedded within living systems.

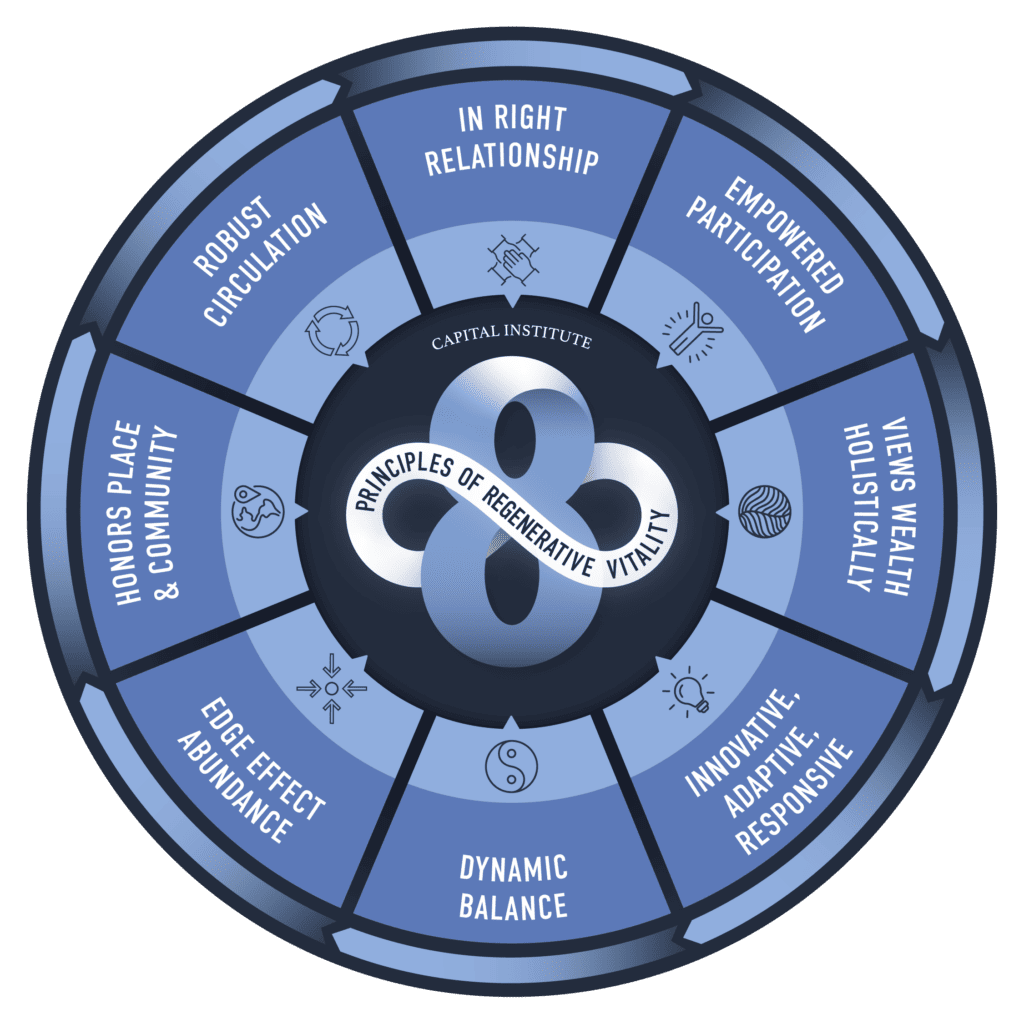

The eight principles of regenerative vitality are rooted in the universal patterns and principles the cosmos uses to build stable, healthy, and sustainable systems throughout the real world as the model for reimagining our global financial systems in service to a regenerative economy.

Together, these principles form a holistic framework for understanding and engaging with the world in a way that fosters regeneration, resilience, and sustainable growth.

At the forefront of our quest to reimagine Finance, "Introduction to Regenerative Finance" marks the beginning of an enlightening journey into re-imagining genuine financial system transformation.

This white paper navigates through the eight foundational principles of regenerative vitality, highlights the deficiencies in our present financial system, and sowing the seeds for a resilient, equitable global regenerative financial system in service of health, ecological harmony, and a shared and equitable prosperity throughout the world.

“Introduction to Regenerative Finance” is the first installment in the “Finance for a Regenerative World” series.

Following this introductory white paper, the series will delve into specific areas of finance, exploring not only the root causes of our current financial system’s disease, but also pave the way towards a genuine financial system reform.

The other two white papers in the series will explore the following concepts:

THE SIX ESSENTIAL FUNCTIONS OF FINANCE

From investment and speculation to risk management and infrastructure, we will be diving deep into the six essential functions of finance and elucidating their profound impact on both economic stability and societal well-being. We will challenge the prevailing “absolute truths” of finance, that have long guided financial activities, uncovering the root causes behind the systemic failures of our current financial system.

REIMAGINING FINANCE: A PATH TOWARDS GENUINE FINANCIAL REFORM

By dissecting the flaws in the current system— from the distinction between investment and speculation, the limitations of markets, and the misalignment of incentives, to the hard choices of limits to investment within Earth’s ecological limits — we will introduce our agenda for genuine financial reform, relying on living systems principles as our guide.

Sign up to the "Finance for a Regenerative World" white paper series to receive your download of the first white paper. You will receive the subsequent two white papers in your inbox two days after the previous one. Join us on this journey toward a regenerative financial future—one where finance acts as a steward to health, ecological harmony, and a shared and equitable prosperity, driving us towards a world where people. plant and businesses not only survive but thrive.

Imagine a Bold Transformation of Finance for The 21st Century: A 2-course Immersive Online Program hosted by John Fullerton

© 2023 All rights reserved