Foreign Policy’s recent “How Goldman Sachs Created the Food Crisis” reflects the dangerous, myopic thinking all too prone to “blame Wall Street” that is a natural consequence of Wall Street’s appalling, anti-social behavior in recent years.

I am no apologist for Wall Street’s modern business practices and ethics, and certainly not for Goldman Sachs, as reflected in this blog and in my 2009 Blankfein Letters. But to confuse the historic shift underway in the commodities markets that is a result of our “full world” economy with Goldman’s or any other Wall Street speculator’s bad behavior is missing the critical point.

The Foreign Policy article begins with a brief nod to supply and demand, but then proceeds to blame the rise in commodity prices on speculation, aided by the creation of the Goldman Sachs Commodity Index (“GSCI”) in 1991 and the deregulation of futures markets in 1999, which, according to the article, removed position limits for speculators.

As the chart on food prices below shows, neither 1991 nor 1999 were particularly relevant years in the history of food prices. In fact, it took nearly a decade after speculators were free to roam before we found ourselves in a food crisis beginning in 2007 and continuing today, interrupted only by the global recession.

It’s also no surprise that the food price crisis is highly correlated with oil prices, given the oil intensity of our unsustainable industrial agricultural system.

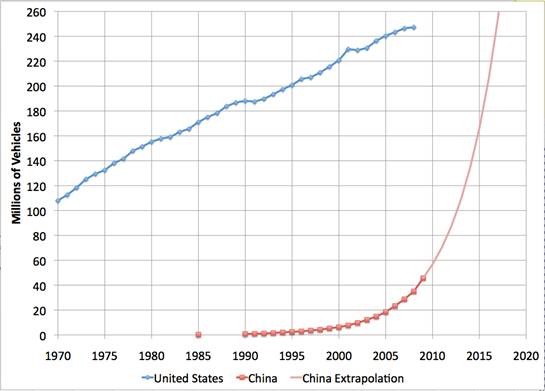

Contrary to what the FP article suggests, there are some very real supply-demand factors driving commodities, as experts ranging from environmentalist Lester Brown whose “The Great Food Crisis” also appeared in Foreign Policy earlier this year, to peak oil experts, to speculator Jim Rogers (and many others) have been saying for years. And the pressure is just beginning, as this chart Richard Zimmerman just sent me from Business Insider on Chinese automobile ownership (and its implication for oil demand) suggests:

I am confident that speculation has exaggerated the degree of the move and the volatility of world food and energy prices. But to suggest speculators caused the quadrupling of oil prices and tripling of food prices (overall) since about 2004 when the structural shift appears to have begun is plain wrong. Supply appears to be having trouble meeting demand at prices that previously cleared the market for literally decades. This is new. This is what happens when perpetual growth runs into the limits on a finite planet ruled by the laws of thermodynamics. It will get worse in the decade ahead, even if pressure is “relieved” by the next great recession.

The FP article is correct however in drawing attention to speculation in commodities. I ran the Global Commodities Business at JPMorgan back in the 1990s, and the thought of unlimited speculation in commodities in the age of resource constraints is indeed alarming and must be addressed.

Too much to discuss in a blog, but here are some ideas needing further attention:

This is a complex subject, requiring careful consideration and planning. While we fight over bank capital requirements and liquidity ratios, we had better add commodity speculation to the priority list with a heightened sense of urgency.

- As ecological economist Herman Daly has reminded us, free markets (regulated or not) do not solve scale problems. We’ve learned this though the depletion of the global fisheries, and in the disaster in the California electricity market (remember Enron). In the face of supply constraints in individual commodities not resolved by markets without unacceptable demand destruction (in basic needs of food and energy), some form of market intervention/control will be needed to avoid unacceptable short “squeezes”. This will be resisted by free market ideologues, but their ideology is flawed.

- The first step in market intervention must be to limit the scale of speculation. This will be very challenging and must be done comprehensively. It will be fiercely resisted by the powerful interests of bank and non-bank speculators, their institutional investor clients, and by the private exchanges that benefit from trading volume. Real end users in the real economy (farmers, airlines, food companies), whose interests commodity futures markets were initially designed to serve, will be relieved.

- Some amount of speculation in markets facilitates the price adjustment process and provides needed liquidity. This does not imply more speculation is better.

- The notion of commodities as an “asset class” is now accepted conventional wisdom. This concept made sense in the framing of (flawed) modern portfolio theory, given the diversification and correlation benefits. But if any commodity becomes structurally scarce, which I believe is happening, MPT abstraction must be overridden by real-world economy limitations. Indeed, defining “commodities as an asset class” will in the future be seen as an unintentional but immoral error.

- The Bank Holding Company Act of 1956 precludes “banks” from operating in the physical commodities business. During the panic of 2008, all the investment banks rushed to convert to Bank Holding Companies, in order to have access to the Fed’s discount window as their lender of last resort. Lehman didn’t make it. Over the years, the Fed has loosened up this restriction on certain banks such as JPMorgan to allow them efficient hedging of their customer driven commodity derivatives portfolios. Customer hedging of jet fuel for example is a different activity in kind and scale than Goldman and Morgan Stanley’s physical trading driven commodities businesses including all aspects of fuel trading, even ownership/control of refineries and tanker fleets. Morgan Stanley, and now JPMorgan as a result of its acquisition of Bear Stearns, own power plants and no doubt actively trade the relationships between natural gas and electricity, an interesting business, but not one we the taxpayers should be subsidizing and providing a liquidity backstop for via the Fed. Imagine if Enron had had privileged access to the Fed’s discount window? The creators of the Bank Holding Act understood the risk (think Exxon Valdez) and potential for abuse (think Enron and California electricity markets) if large banks came to dominate physical commodity markets. It’s time we enforced the law.

- An obvious policy tool to dampen the speculative activity in commodity markets is the Financial Transactions Tax (FTT). My arguments in favor of a FTT and my rebuttal to the liquidity argument against FTT is laid out in my 2010 press briefing on FTT.

- Additional tools to contain speculative trading in commodities include open position limits, much higher margin requirements for traders (I see no reason why we don’t impose 50% margin requirements on positions exceeding a certain threshold), similar collateral requirements for over-the-counter derivatives trading, and even a surtax on short-term speculative profits from strategic commodities.

- A conversation needs to begin with institutional investors about how to place limits on passive commodity index speculation (regardless of anticipated holding period), where a little activity is systemically harmless, but a lot in the face of physical scarcities will carry unacceptable human and political consequences.

This is a complex subject, requiring careful consideration and planning. While we fight over bank capital requirements and liquidity ratios, we had better add commodity speculation to the priority list with a heightened sense of urgency.