I am no Middle East expert, and clearly there are a multitude of factors beyond a humiliated fruit cart vendor in Tunisia that have triggered the revolutions playing out on our nightly news. Certainly decades of repression and unfathomable corruption (Mubarak is thought to have in excess of $40 billion invested securely outside Egypt) are primary drivers. But I would like to focus on food and energy. A consensus is emerging that dramatic increases in food prices are also a root cause of the revolutions in Tunisia and Egypt, as reflected by an article in Scientific American titled: “Are high food prices fueling revolution in Egypt?” This is the story that first surfaced in 2008, causing riots throughout Africa and Asia, and across the Middle East including Egypt. The food crisis is a complex subject, but at its core, it is a story of ever-rising population and improving standards of living conflicting with declining agricultural productivity for numerous reasons ranging from soil depletion, to water depletion, to the world’s ever expanding urbanization, to climate events that have created supply shocks in places like Russia, Pakistan, and Australia. Speculation by both physical end-users and financial players no doubt have exacerbated the price moves, but classic supply and demand imbalances are at the core. Allegations that Ben Bernanke’s QE2 policy has triggered food price inflation conflict with the fact that the money supply has actually been shrinking (by definition) with the global credit contraction the Fed is trying to offset. After a reprieve caused by the global recession, those same pressures have again triggered dramatic rises in prices that are failing to stimulate the kind of supply response free market disciples would predict. After nearly two decades of relative price stability, something appears to have shifted around 2007, as this UN Food and Agriculture Food Index chart depicts:

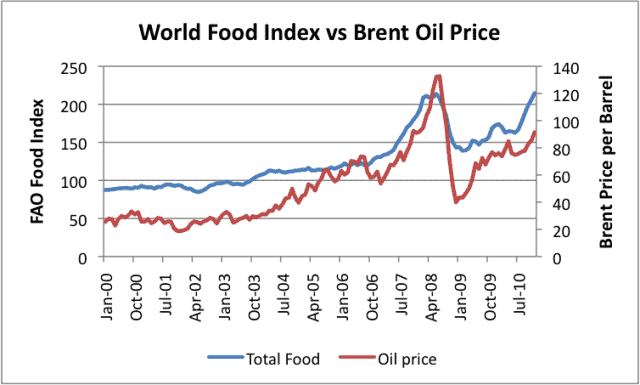

The Oil Drum has a good piece called “What’s Behind Egypt’s Problems” on the situation in Egypt and its linkage to oil. The following chart from The Oil Drum piece showing the correlation between oil prices and food prices tells the critical story:

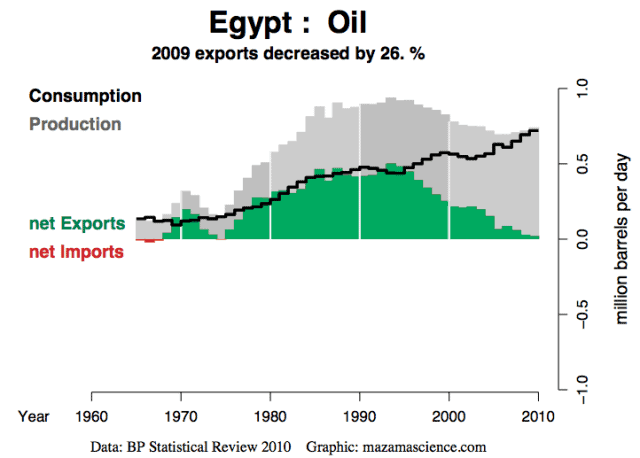

Oil is a crutial input to our unsustainable industrial agriculture system, and it appears increasingly like the peak oil believers are proving to be right. Annual oil production has failed to rise since 2006, even in the face of growing demand and a tripling in prices over the past decade. It appears we are hitting the limits to growth, when physical boundaries interfere with the free market assumptions of our theoretical economics framework. We ignore this shift at great peril. The onset of peak oil changes everything. It will start in areas that are most vulnerable, like Egypt, as we have learned this week. But its implications will be felt universally in our fossil fuel dependent global economic system. To see peak oil in Egypt itself, see the following chart, also from the Oil Drum:

Ever rising consumption combined with peak production in about 1995 has led to the steady decline in oil exports pretty much to zero, making food subsidies increasingly impossible in the Egyptian economy. This picture is now playing out throughout the Middle East as populations and standards of living rise. I have consistently been surprised at how unconcerned mainstream economists are about the physical throughput limits of the real economy, and how ignorant the investment community is regarding peak oil in particular. We live in an optimistic paradigm that we will engineer the solutions, as we have in the past. It appears increasingly likely to me that resource constraints, from oil to soil, from cotton to corn, will increasingly interfere with the presumption of ever expanding economic growth. Limits on the quantities of carbon we dump into the atmosphere will have the same affect, if we ever muster the political will. Should we take down the long-term growth expectations for the world economy? I think so. Not good for our sovereign debt crisis. Hold on tight.